Do you have clear financial goals?

Can you handle major unexpected expenses?

Did you secure your financial future?

If you answered all the above questions with a “Yes” then you are financially well! However, if you answered “No” to at least one question, then you are not alone. Concerns about money usually top the list of most frequently cited sources of stress.

Financial wellness is known by many names – like financial literacy, wellbeing, confidence, or healthiness – but put simply, it’s about having a good relationship with your money.

Because each person’s situation is unique and subjective, it is hard to describe financial wellness using only numbers like income, expenses & net worth. Financial wellness should have the same meaning to all of us. It is having financial security and financial freedom of choice, in the present and the future. To be more specific, being financially well is when you:

• have control over day-to-day, month-to-month finances

• have the capacity to absorb a financial shock

• are on track to meeting your financial goals

• have the financial freedom to make the choices that allow you to enjoy life

That’s why people with the same income, financial experiences, or education can have very different levels of financial wellness.

Not only that, but when it comes to personal finances, balance is critical to your success. Maintaining the balance between different financial dimensions helps ensure that every aspect of your finances gets the attention it needs. As a result, you can avoid problems with debt and make headway to reach your financial goals, too.

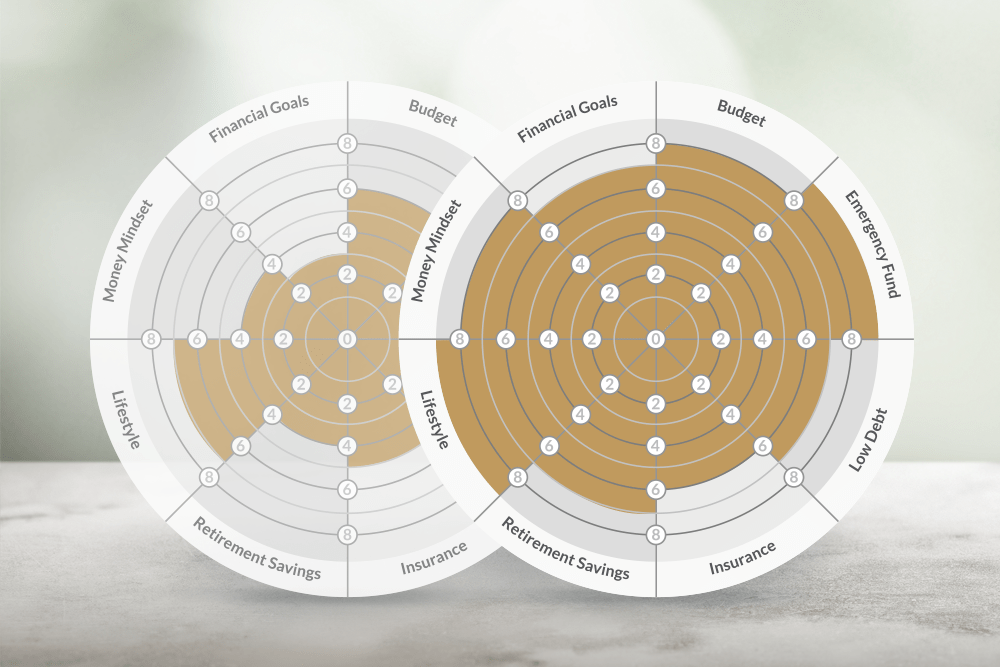

What if I told you that eight dimensions can help you assess the level of your financial wellbeing. That’s the idea behind a Financial Wellness Wheel.

A Financial Wellness Wheel can guide you on how best to balance your time, money, and effort among the different dimensions of your financial life.

Sit back, take a deep breath, and with full honesty reflect on these eight interrelated areas of your finances:

Financial Goals: Do you have financial goals you are working towards?

Budget: Do you have a budget that helps you stay in control of your money?

Emergency Fund: Can you handle major unexpected expenses?

Low Debt: Are you able to pay more than the minimum payment each month?

Insurance: Do you have proper coverages that protect you from misfortunate happenings?

Retirement Saving: Are you contributing to a retirement fund regularly?

Lifestyle: Do you spend less than you make each month?

Money Mindset: Do you have challenges making the right financial decisions?

Making the time to work on your “Financial Wellness Wheel” can give you a baseline for your current financial health and help you assess where you stand, what is holding you back, and what areas you need to improve to celebrate wealth.

You can simply rate yourself on a scale from one to eight in each of the above areas; “one” being not satisfied at all and “eight” being super satisfied. Then ask yourself some important questions.

• Which of these dimensions would you most like to improve?

• What would it take to increase your scoring in each dimension?

• What support might you need from others to make positive steps forward?

The final step after completing your financial wellness wheel is to identify and write down one action for each dimension that you will commit to.

In a nutshell, look at the big picture and start building habits that can help you make better financial choices leading to improved financial health.

What are you waiting for? Start now and make sure to mark the date to reflect again in six months to assess your financial wellness wheel and celebrate the positive change that you have made!

Group workshops are available, for more information please visit Financial Wellness Wheel event page.